by: Kevin Zwick, CEO, Housing Trust Silicon Valley

Today, I had planned to welcome more than 600 friends and neighbors at our annual Investor Briefing to celebrate our collective work and Housing Trust’s 20th anniversary. But a week ago, we heeded the call to do our part to slow the spread of the COVID-19 and cancelled the event. While it was a disappointing decision to make given the knowledge that would have been shared from the stage by our amazing line up of speakers and that would have been shared as connections were made among our incredible group of attendees, we believe that there is nothing more important than the health and well-being of our community.

Adapting to new challenges like the one we are all facing now is very much in Housing Trust’s DNA. Twenty years ago, the organization was founded in the bubble of the first dot-com boom and bust to meet the housing needs in that moment, rose to the challenges of the Great Recession and Foreclosure Crisis and, most recently, we are evolving to meet the needs of the current housing crisis. And, we will work with you all on addressing this new challenge to meet the needs of the people we serve.

I mentioned the Great Recession and Foreclosure Crisis, and that is where I entered the Housing Trust’s story. Before I came here, I was developing affordable housing for a local nonprofit developer. We, along with our colleagues at other nonprofits, faced huge challenges securing sites for our projects. When we did find a piece of land was perfect affordable housing development, that more often that not meant that it was perfect for market rate development as well and that put us in competition with market rate developers who had deeper pockets and could act on shorter timelines.

Even when we were successful getting into contract, we had one shot at buying the property and we needed to close before the seller could change their mind and go with another offer. I remember going to the traditional funding sources to try and raise capital for a site – but cities couldn’t move fast enough; banks said affordable housing acquisition lending was too risky, and the nonprofit loan funds, the CDFIs, also didn’t work for one reason or another usually due to cost or speed. I thought, if I ever got the chance I was going to disrupt this – to help make the affordable housing finance system work better.

I got that chance when Linda Mandolini and Leslee Guardino reached out to me in 2008 and asked if I wanted to join Housing Trust, which I only knew from reputation – I thought it was amazing that this organization had raised grant dollars from Adobe, HP, Applied Materials and others and were putting it to work for affordable housing. This is taken for granted today, but back then affordable housing was not top of mind for philanthropy.

Fast forward to today – We have become the leading nonprofit lender for housing in the greater Bay Area – In the last three years alone we’ve lent over $204 million and we’re moving to have even Bolder Measures, which will lead to Greater Equity.

Last year, when I gave my remarks at Investor Briefing 2019, I talked about how the work of Housing Trust has to not only create more affordable housing and bring in more corporate partners to affordable housing – we have to, along with the entire nonprofit sector, focus more on dismantling racism and the unequal power structures they created. Our staff at Housing Trust created a working group on equity and inclusion for these purposes.

Through this work, we’ve continued to learn that housing opportunities aren’t just important for the individuals and families that receive assistance, they’re important to right past wrongs created by a system that too often leaves African American, Hispanic/Latinx, Native American and other communities of color behind.

One of the things I’m referring to is the racial wealth gap – the median wealth of white households in America is 13 times larger than black households. Since very few homes on the market are affordable in our region, they are that much further out of reach for most black and Hispanic/Latinx homebuyers. When greater Bay Area families cannot secure homeownership, we all lose out on diversity, a skilled and dynamic workforce, and a strong community.

Steps are already being taken to reverse the wealth gap. Thanks to Measure A, Housing Trust is administering Empower Homebuyers SCC, which was created by the County of Santa Clara. It is a powerful tool to help low- and moderate-income families in the Santa Clara County purchase their first home. If we bring more homes within reach, if we equalized the black and white homeownership rate and both groups had access to equal buying power, studies suggest that we could reduce the wealth gap by half.

Racial disparities also arise from land use policies. Historically, policies restricting multi-unit development – like duplexes, triplexes and apartment building – were used to keep people of color out of certain neighborhoods. But, if we want affordable housing everywhere in a city, we have to make it legal to build affordable homes everywhere. In San Jose, for example, 94% of the land zoned for residential does not allow apartment buildings – and throughout the Bay Area there are still too many barriers in allowing owners of single-family homes to build ADUs.

Building affordable rental housing is important for families experiencing crushing rents, overcrowding, and mega commutes; it is also a key strategy to prevent gentrification and displacement, when those families most affected by the lack of affordable housing are brought into the process of creating new homes in their community.

A great example of this is Quetzal Gardens, developed by Resources for Community Development in conjunction with Somos Mayfair, in San Jose. We were very proud to provide this development with a critical $4.2 million loan to help RCD and look forward to this being a model for future development of not just the Mayfair but anywhere affordable housing is proposed in a community at the forefront of displacement.

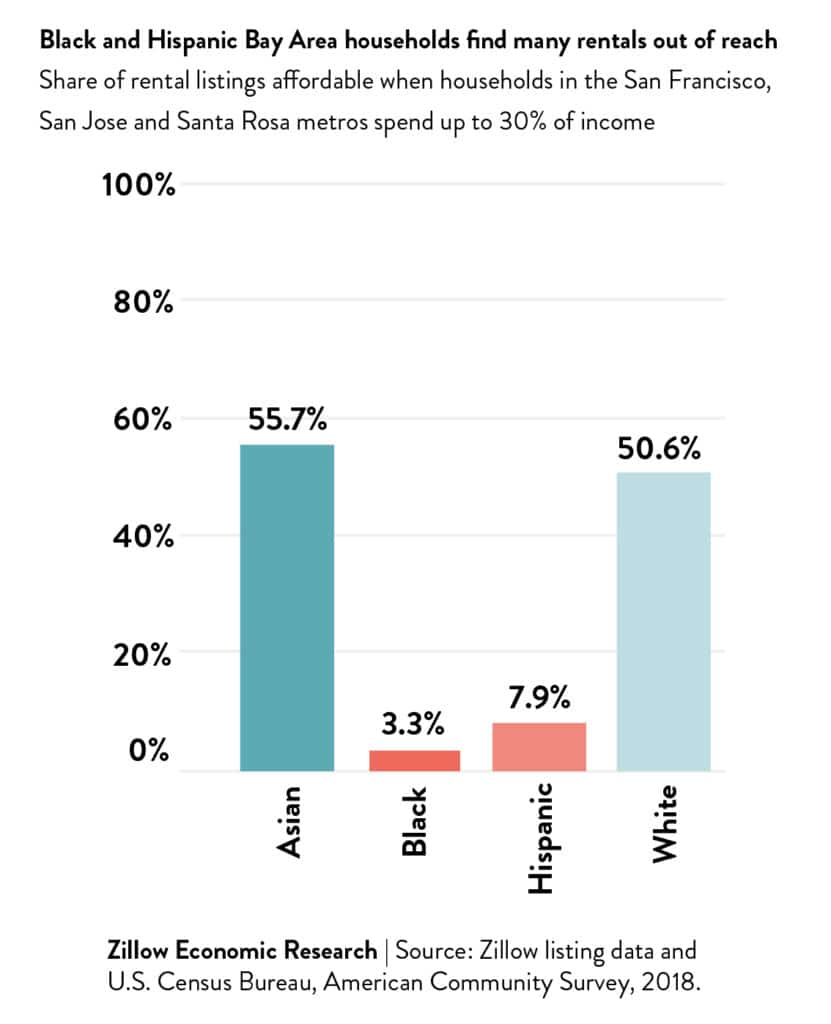

This is important, since we know that the burden of high rents and low incomes aren’t spread equally across racial and ethnic groups in our region. According to Zillow, black and Hispanic households could afford far fewer rental homes on the market than white and Asian renters —just 3.5% and 5.6%, respectively. This means if we don’t build more housing, and make it affordable and accessible, then we will push more and more black and Latinx/Hispanic families out of their community.

Our multifamily lending programs work to minimalize that loss. And we continue to do more multifamily lending than any other nonprofit lender in the greater Bay Area – providing critical capital to build and preserve affordable homes for those experiencing homelessness, extremely low income households and very low income renters.

We believe our communities are more diverse, sustainable, and vibrant when everyone has a safe, stable and affordable place to live, and a chance to succeed on their own terms. When developers partner with a lender that both navigates financing reliably and is also a trusted leader in addressing affordable housing in the community, affordable housing becomes a reality.

We’re proud to announce that over the past year three years, Housing Trust has made over 50 loans to developers to acquire land and buildings to create or preserve over 4,800 affordable homes in the greater Bay area. And we’ve made loans out of our Supportive Housing Fund to more than half of all the Measure A projects funded so far. But the gap we need to fill is in the tens of thousands of homes.

We will get there with Bolder Measures and Greater Equity.

Last year, Housing Trust – staff and our board – approved a new three-year strategic plan with an audacious new goal: $1 billion of impact for affordable housing in the greater Bay Area by 2025.

Given the importance of the crisis, the opportunity we have in front of us, and the major need, we must do more and we must do it faster. In addition to our TECH Fund and Empower Homebuyers SCC program, you’ve heard last week we announced a new $150M partnership with Apple. Using the Apple Affordable Housing Fund, Housing Trust will deploy new solutions, accelerate construction timelines and house families faster by making loans to qualified developers for affordable housing in the greater Bay Area. Taken together, we are already on the way.

So that’s our challenge and our goal – $1 billion of impact. To date, we’ve invested $335 million into affordable housing, creating over 20,000 homes and have helped more than 36,700 people. We have demonstrated that we are up to the challenge.

I told you what our challenge to ourselves is – $1 billion of impact – and, now, this is our challenge to you. Get involved, there are so many different ways. You can invest in our TECH Fund, you can provide operating support grants or donations so we can keep the lights on. You can have us come talk to your employees about the importance of affordable housing and how to get involved. You can support important ballot measures that increase funding for affordable housing like San Jose voters just did for Measure E. You can build an ADU in your backyard. You can show up at a community meeting and speak in favor of new housing.

The vitality of our region depends upon our collective success. Our neighbors are not interested in the size of our funds or our strategic plans. They are interested in having a shorter commute so they can see their family more every night. They want their special needs daughter to have a stable place to live and keep seeing the doctor she’s known her whole life. They want to live close enough to their parents to have dinner every Sunday. They want a house big enough so their kids can play hide-and-seek. They crave a stable enough life to pick out curtains, save money for their family’s future, and actually be involved in their communities. These are just some of the thousands of people we’ve helped recently. They care about opportunities – and together we can provide that for them.

Even though we’re not together at Investor Briefing today, we are still celebrating our first 20 years and look forward to boldly growing our work to solve the challenges facing our region, shaking up affordable housing finance systems and preserving our communities as places for opportunity for all. To achieve bolder dreams, we will engage more partners, pioneer innovative programs, and continue to be a solutions focused organization dedicated to our belief that safe, stable and affordable housing opens the door to better lives for everyone.

Now is not the time to slow down or back away from challenges. Now is the time to work together for Bolder Measures, and Greater Equity.

Thank you for supporting the work of Housing Trust.